We believe secondaries are one of the most effective ways to unlock liquidity, strengthen domestic ownership, and back India's breakout companies at scale.

This year, with over ₹1,000 Cr deployed in secondaries across marquee names, Oister has become the first call for investors, founders, and GPs seeking liquidity and disciplined entry into India's private markets.

Secondaries raised a record $81B in H1 2025 - the strongest first half ever, bigger than full year totals of 2021 and 2022. This strong growth led to the strategy ranking second, with 17% of private equity fundraising.

The median IPO age has climbed from 6.9 to 10.7 years in the last decade. With public exits delayed, a liquidity vacuum has emerged - one increasingly filled by secondaries.

Global secondaries deal volume is on track to cross $210B in 2025, an unprecedented scale. H1 2025 hit $103B, up 51% y-o-y, while 2024 closed at $162B, a 45% jump on the prior year.

Dedicated available capital for secondaries hit a record $302B in H1 2025, up from $288B at end-2024

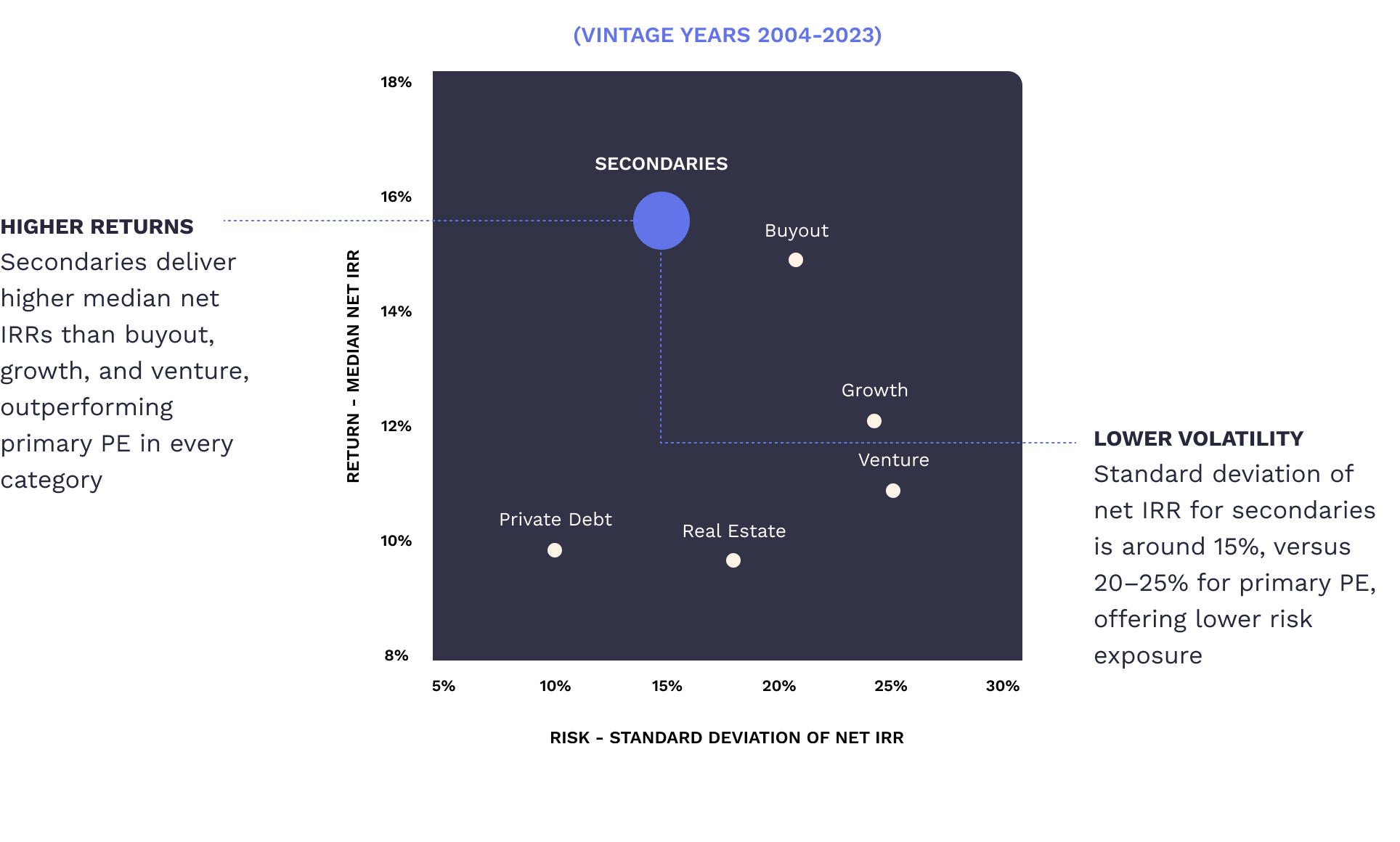

Risk-Return Profiles of Private Market Asset Classes (Global Data)¹

Capital comes back sooner through quicker distributions and earlier DPI.

Pricing tied to demonstrated performance, not projections.

Clearer timelines and more predictable outcomes for capital return.

Exposure to proven companies with aligned long-term partners.

A focused window to invest in proven businesses, with clear execution and visible paths to liquidity

Oister's secondaries strategy is designed for institutions, family offices, and sophisticated investors seeking compounding with visibility and discipline.

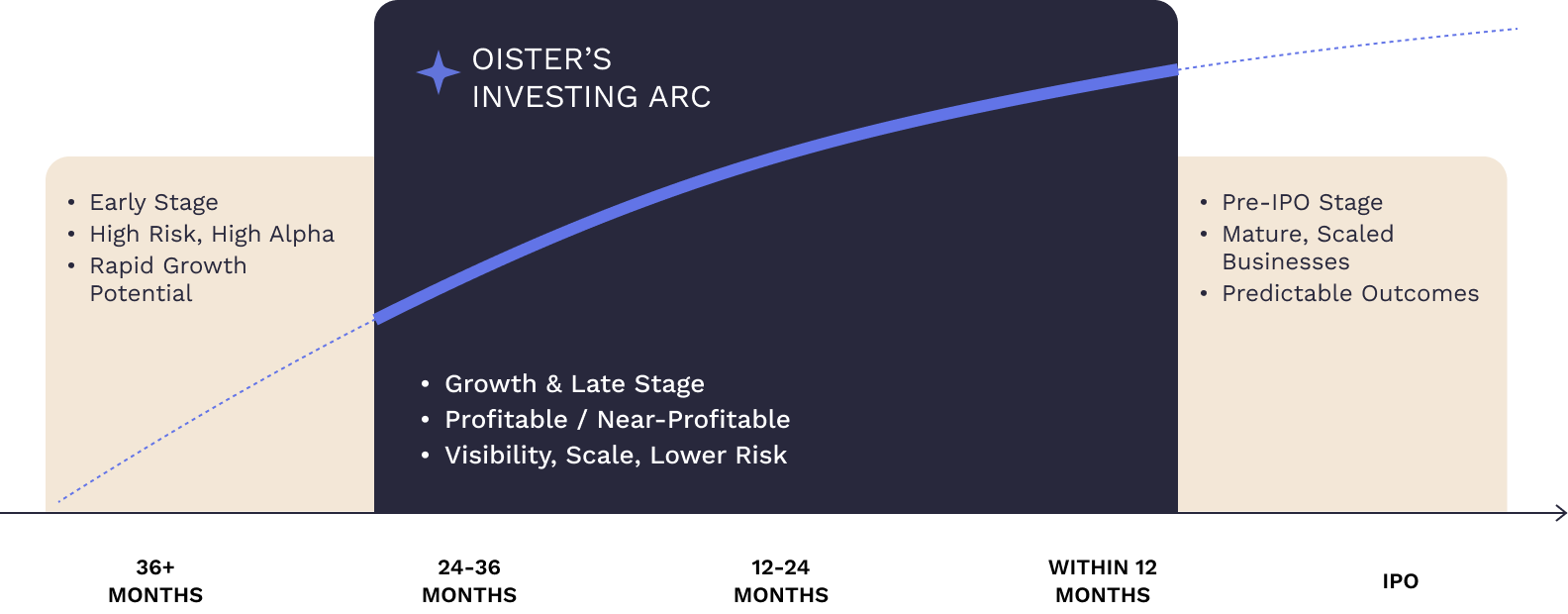

We allocate at scale into India's breakout companies — profitable, near-profitable, and IPO-bound.

The best companies don't wait until IPO to plan liquidity.

At Oister, we work with high-growth, profitable or near-profitable firms to create clean pathways 12-36 months before exit.

Our role is simple:

When the time is right, the best founders know where to turn.

Important information

The information on the website of Oister Global is for informational purposes for creating awareness about private markets as a financial product and is not meant for sales, promotion or solicitation of business or investment.

Content on this website may be taken from sources that are believed to be reliable (but may not necessarily have been independently verified), and such information should not be relied upon while making investment decisions. The content herein does not take into account individual investor’s objectives, risk appetite or financial needs or circumstances or the suitability of the products. Hence, investors are advised to consult their professional investment adviser/ consultant/ tax advisor for investment advice in this regard.

An investor should, before making any investment decision, seek appropriate professional advice.